Bristlecone Equity Fund

Investment Objective

Portfolio is designed for investors seeking a secularly advantaged, concentrated, high-alpha approach to growth. Portfolio typically invests across cap curves targeting those companies that exhibit secular growth characteristics, sustainable competitive advantages and reasonable valuations based on our analysis of fair value.

Stock Selection Criterion

5 quantitative factors and 2 qualitative factors are used for stock selection.

Quantitative Factors

High Return Ratios

The higher the returns on equity and capital employed over weighted average cost of capital (WACC), the higher is the value addition by the companies to its minority shareholders. Studies have indicated that companies with superior return ratios outperform companies with poor or lower return ratios. Return ratios are averaged over a 5-year period to smoothen out lumpiness and volatility (if any).

Minimum Leverage

Investments will be made in those companies that can grow without leveraging the balance sheet. In a high interest rate environment like the present one, interest outgo will pinch bottom line and therefore shareholder wealth. Minimal debt for purpose of working capital is acceptable. Long term debt for the purpose of expansion, Greenfield etc is avoided.

Market Cap Threshold

Will invest in companies with market cap of not less than 1000 crores which will avoid small companies with lesser float, but at the same time will avoid investing in companies which are very large and themselves find it difficult to grow.

Capital Light

Generally companies with very high fixed asset turnover ratios are preferred. Hence, asset heavy businesses are discarded and entry barriers in these cases are mostly due to the company’s brands and the space it operates in. Most companies that pass this filter will generate sufficient cash flows to fund their capex without external borrowings.

High Operating Leverage

Companies that are in a better position to absorb rise in raw material prices and companies that are able to easily cut its cost by increasing volumes are preferred especially in uncertain environments like the one we have at present.

Qualitative Factors

Minority Shareholder Interest

Identifying managements that have generally kept in mind and have acted in the interest of minority shareholders, do not frequent capital markets (for raising funds) and have been rational in their decisions.

Strong Brands & Market Presence

Brand pull will enable companies to pass on higher raw material costs to consumers. Brand pull will also ensure that consumers continue to purchase the products with their reduced purchasing power in a high inflationary environment.

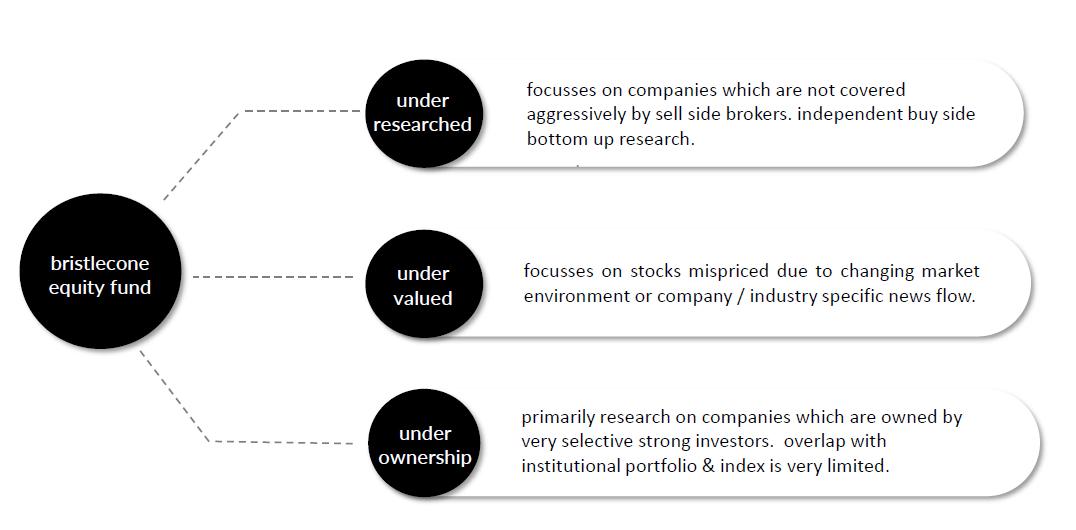

u3 mandate